2. Instruments of Fiscal Policy

Fiscal policy is carried out by the legislative and/or the executive branches of government. The two main instruments of fiscal policy are government taxes and expenditure. The government collects taxes in order to finance expenditures on a number of public goods and services. The effect of government expenditures, taxation, and debt on the aggregate economy is of immense importance.

Three distinct functions that operate through the fiscal policy of the government are:

1. Certain goods, referred to as public goods (such as national defence, roads, government administration), as distinct from private goods (like clothes, cars, food items), cannot be provided through the market mechanism, i.e. by transactions between individual consumers and producers and must be provided by the government. This is the allocation function.

2. Second, through its tax and expenditure policy, the government attempts to bring about a distribution of income that is considered ‘fair’ by society. The government affects the personal disposable income of households by making transfer payments and collecting taxes and, therefore, can alter the income distribution. This is the distribution function.

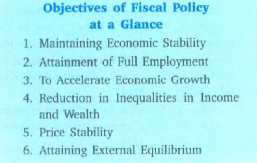

3. Third, the economy tends to be subject to substantial fluctuations and may suffer from prolonged periods of unemployment or inflation. There may be times when extra government expenditure is needed to raise aggregate demand. There may be times when expenditures exceed the available output under conditions of high employment and thus may cause inflation. In such situations, restrictive conditions are needed to reduce demand. These constitute the stabilisation requirements of the domestic economy.

Note: Public provision of goods is not the same as public production. Public provision means that they are financed through the budget and made available free of any direct payment. These goods may be produced directly under government management or by the private sector.