Demerits of Direct Taxes

The major drawbacks with the direct taxes are as follows:

♤ Unpopular – tax payers feel the pinch directly as they can’t be shifted.

♤ Possibility of tax evasion as people can conceal their income or adopt some fraudulent practices to pay less taxes

♤ Inconvenient – maintenance of elaborate accounts and need to observe various formalities make the process inconvenient

♤ Adverse effect on the will to work and save – For example if property and inheritance are taxed, it will discourage the people to save

♤ Arbitrariness – the rates are arbitrarily fixed by the government

♤ Narrow in scope – because imposed on certain groups of people not all the groups.

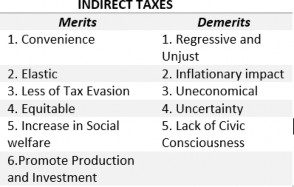

An indirect tax is tax that can be passed on to another person or group. A business may recover the cost of the taxes it pays by charging higher prices to customers. A tax shift occurs when the business shifts its taxes to others.

Excise Duties and Custom Duties are examples of indirect taxes while rest of the above mentioned taxes are direct taxes.