A good tax system should meet five basic conditions: fairness, adequacy, simplicity, transparency, and administrative ease.

Fairness, or equity, means that everybody should pay a fair share of taxes. There are two important concepts of equity: horizontal equity and vertical equity.

Horizontal equity means that taxpayers in similar financial condition should pay similar amounts in taxes.

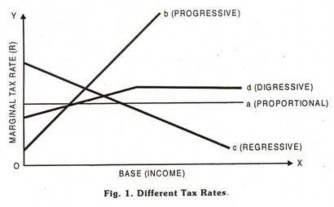

Vertical equity is just as important, however. Vertical equity means that taxpayers who are better off should pay at least the same proportion of income in taxes as those who are less well off. Vertical equity involves classifying taxes as regressive, proportional, or progressive.

Taxes can also be categorized as either regressive, proportional, or progressive, and the distinction has to do with the behaviour of the tax as the taxable base (such as a household's income or a business' profit) changes.(see graph below)

♤ Progressive tax—A tax that takes a larger percentage of income from high-income groups than from low-income groups.

♤ Proportional tax—A tax that takes the same percentage of income from all income groups.

♤ Regressive tax—A tax that takes a larger percentage of income from low-income groups than from high-income groups.

♤ Degressive tax – The rate of progression in taxation does not increase in the same proportion as the increase in income.

Progressive taxation is the most popular owing to the following reasons:

♤ It leads to equitable and just distribution of burden of taxes as it imposes higher tax burden on the rich

♤ It helps in reducing inequalities of income and wealth

♤ These are elastic as revenue of government increases substantially with the increase in tax rate

♤ It is productive because increase in income automatically brings in more revenue

♤ These are economical as the cost of tax collection does not increase with the increase in tax rates

Adequacy means that taxes must provide enough revenue to meet the basic needs of society. A tax system meets the test of adequacy if it provides enough revenue to meet the demand for public services.

Transparency means that taxpayers and leaders can easily find information about the tax system and how tax money is used. With a transparent tax system, we know who is being taxed, how much they are paying, and what is being done with the money. We also can find out who (in broad terms) pays the tax and who benefits from tax exemptions, deductions, and credits.

Administrative ease means that the tax system is not too complicated or costly for either taxpayers or tax collectors. Rules are well known and fairly simple, forms are not too complicated, it is easy to comply voluntarily, the state can tell if taxes are paid on time and correctly, and the state can conduct audits in a fair

and efficient manner. The cost of collecting a tax should be very small in relation to the amount collected.

Note: The Laffer Curve shows the relationship between tax rates and tax revenue.

This graph shows that as the tax rate increases from zero, the amount of tax revenue collected will

increase. At point T*, however, increases in the tax rate lead to decreases in the tax revenue collected. Governments would like to be at point T*, because it is the point at which the government collects maximum amount of tax revenue while people continue to work hard. This would theoretically be the point at which potential GDP is maximized.