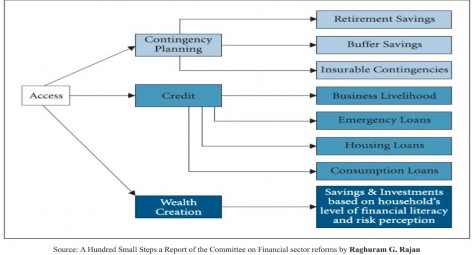

Household Access to Financial Services

History of Financial Inclusion in India

♤ Financial Inclusion (FI) as a policy initiative entered the banking lexicon only after the recommendations of the Rangarajan Committee in 2008. It began to attract the attention when banks realized the significance of connecting with more people for business growth.

♤ The span of financial services included provision of basic savings accounts, and access to adequate credit at affordable costs to vulnerable groups such as the excluded sections of the society and low-income households.

♤ The experience of microfinance units in India and abroad shows that vulnerable groups who pay usurious interest rates to local moneylenders, can also be worthy borrowers of banks.

♤ One of the broader objectives of FI is to pull the poor community out of the net of exploitative moneylenders. But despite such emphasis, the penetration of banking services was initially mostly confined to urban areas and major cities. Later to the hinterland.

♤ In 2010, RBI advised all the banks – private as well as public- to submit a broad based, three Financial Inclusion plan. This made FI critical to business domain of banks.

♤ These plans broadly included

o Self-set targets in terms of bricks-and-mortar branches in rural areas,

o Deployment of Business Correspondents (BCs)

o Use of electronic/kiosk modes for provision of financial services.

o Opening of no-frills accounts.

♤ For the dispensation of credit, Kisan Credit Cards (KCC), General Credit Cards (GCC), and other specific products designed to cater to the financially excluded segments, were introduced. Such accelerated microcredit was part of priority sector lending schemes of banks.

♤ Among associated developments, RuPay – an Indian domestic debit card – was introduced in 2012 by the National Payments Corporation of India (NPCI). It has been a game changer in creating better digital infrastructure and enabled faster penetration of debit card culture in India.