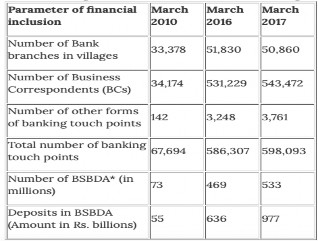

Progress of Financial Inclusion in India

♤ It was after 2010-11 that the process of FI accelerated. Commercial banks opened new rural branches, increased coverage of villages, set up ATMs and digital kiosks, deployed BCs, opened no-frills accounts, and provided credit through KCCs and GCCs.

♤ The introduction of core banking technology and proliferation of alternate delivery channels (ATMs, Kisoks, Net banking) aided the process of inclusion on a larger scale.

♤ Following graph depicts the accelerated growth of FI: