2.5.1. Special Category Status to States

Various Chief Ministers across the nation have been demanding special status for their respective states since last few years. Recently, Andhra Pradesh MPs have been protesting for special category status for the state which centre has refused. The demand is claimed on the basis of Andhra Pradesh Reorganisation Act which provides that “the Central Government may make appropriate grants and also ensure that adequate benefits and incentives in the form of special development package are given to the backward areas of that State”.

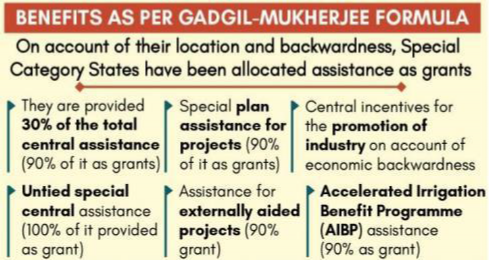

The whole idea of a special category state was introduced in 1969 by the Fifth Finance Commission, which as per the Gadgil formula gave special status to the states of Nagaland, Assam and Jammu and Kashmir. Today eleven states in the country enjoy this status including seven north-eastern states, Sikkim, Jammu Kashmir, Uttrakhand and Himachal Pradesh.

As per the Gadgil formula “special status” is to be given to certain states because of certain intrinsic factors which have contributed to their backwardness historically. Some of these factors include:

(i) Hilly and difficult terrain;

(ii) Low population density or sizable share of tribal population;

(iii) Strategic location along borders with neighbouring countries;

(iv) Economic and infrastructural backwardness; and

(v) Non-viable nature of state finances

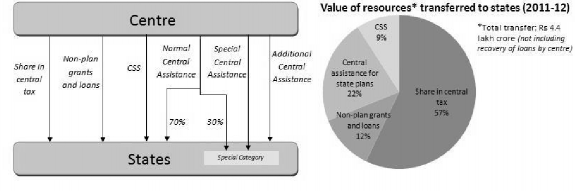

In India, resources used to be transferred from the centre to states in many ways (see figure below).

However, after the 14th Finance Commission, centre claims that there is no need of Special Category Status to States owing to the increased tax devolution to states from 32% to 42% of divisible pool of central taxes.

Moreover, it seems that since Planning Commission ended, there has been a drastic cut in the allocation to SCS and the difference between funds allotted to SCS and other States have been sizeably reduced and the status has remained more of symbol of Political mileage. Further, the situation of the states having SCS does not show any perceptible improvements in terms of industrialization, aiming which they received tax incentives such as capital investment subsidy, excise duty and income tax exemptions, and transportation cost subsidies.

Further, granting status to more states would lead to intensification of similar demands from states such as Odisha, Bihar, Chhattisgarh and Rajasthan.

One way of moving forward may be abolition of "SCS" and introduction of the "least developed states' category as recommended by Raghuram Rajan committee (2013). It should be based on the 10 equally weighted indicators for monthly per capita consumption expenditure, education,

health, household amenities, poverty rate, female literacy, percentage of the Scheduled Caste/ Scheduled Tribe population, urbanisation rate, financial inclusion and physical connectivity. It would help in better understanding the development needs of individual states.