6.2. Role of Microfinance Institutions in Development

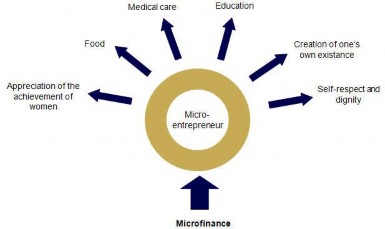

♤ Women Empowerment: Microfinance institutions are playing a major role in empowering the women force in India. By offering financial services to the poor unprivileged women of the country, the institutions have opened a door for their economic growth. Uneducated, poor and unemployed women

usually don't get access to loans from typical lending organizations and this is where the MFIs have come to their help.

♤ Rural Development: More than subsidies, poor need access to credit. Absence of formal employment make them non 'bankable'. This forces them to borrow from local moneylenders at exorbitant interest rates. MFIs enhance credit to poor even in the absence of formal mortgage.

♤ Financing the unfinanced: The microfinance sector consistently focuses on understanding the needs of the poor and on devising better ways of delivering services in line with their requirements, developing the most efficient and effective mechanisms to deliver finance to the poor.

♤ The World Bank estimates that more than 500 million people have directly or indirectly benefited from microfinance-related operations.

♤ The benefits of microfinance extend beyond the direct effects of giving people a source for capital. Entrepreneurs who create successful businesses, in turn create jobs, trade, and overall economic improvement within a community.

♤ Empowering women in particular may lead to more stability and prosperity for families and subsequently in the society.