4.2. How Does SHGs Function?

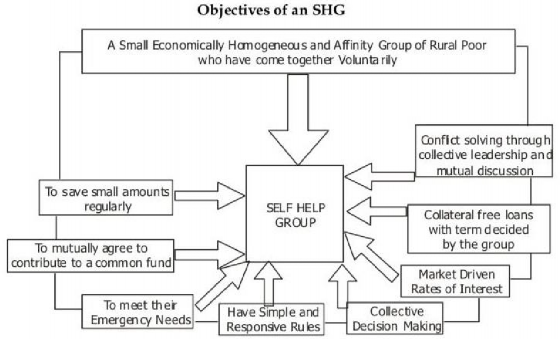

♤ An SHG normally consists of not less than five persons (with a maximum of twenty) of similar economic outlook and social status.

♤ The members of the group help each other to solve their problems. A reasonably educated but helpful local person takes the lead in mobilizing these people to form a group.

♤ The person, called animator or facilitator, helps the group members develop the habit of thrift and promote small savings among them. The group savings are kept in a common bank account from which small loans are given to members.

♤ After six months, the SHG can approach any bank for availing loan facility to undertake a suitable entrepreneurial activity. The group loan is distributed among the members

to run a small business. The loan is repaid out of the profits earned.