5. Financial Inclusion through Digital Payment

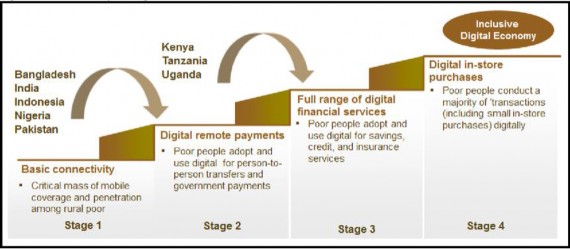

♤ Post demonetization, India has witnessed a significant increase in the usage of cards and digital wallets for low-value transactions. With growing smartphone ownership and internet usage in the country, non-cash, contactless payments have now become quite the norm across tier-I and tier-II cities.

♤ The shift to digital payments has also been fuelled by the unprecedented boom of the Unified Payments Interface (UPI). According to the data provided by the National Payments Corporation of India, which manages the platform, monthly UPI transactions crossed the Rs 1 trillion-mark in December 2018. The figure indicates the widespread adoption of digital payments in India, backed by both home-grown and global companies like Paytm, PhonePe, MobiKwik and Google Pay.

♤ Niti Aayog in its 'Strategy for New India @75' document also emphasised that digital payments will be instrumental in driving financial inclusion and creating financial opportunities for the poor and unbanked.

♤ Several initiatives have been launched by the RBI and the MeitY to promote the acceptance of digital payments, helping India become a predominantly cashless society. These include the launch of UPI-based BHIM app, the promotional scheme of BHIM Aadhaar, cashback scheme for merchants and referral bonus schemes for individuals on BHIM, Digital Financial Inclusion Awareness and Access (Digital Jagriti) programme, and the opening of a free Doordarshan DTH educational channel to create awareness around the digital payment.

♤ While the government put in a lot of efforts to mitigate financial exclusion, India still has a long way to go before it achieves the target set by the RBI.

♤ In urban centres, the increasing cost for merchants hinders the adoption of digital payments, whereas, in rural India, the limited availability of payments infrastructure is identified as the major challenge to financial inclusion

A Digital Pathway to Financial Inclusion

6. Measuring Financial Inclusion in India

♤ India’s first Financial Inclusion index was launched in 2013 based on four critical dimensions:

o Branch penetration

o Deposit penetration

o Credit penetration

o Insurance penetration.

♤ CRISIL Inclusix measures progress on Financial Inclusion down to the level of each of the 717 districts in the country. The index is based on data provided by RBI, the Microfinance Institutions Network (MFIN), and the Insurance Information Bureau of India.

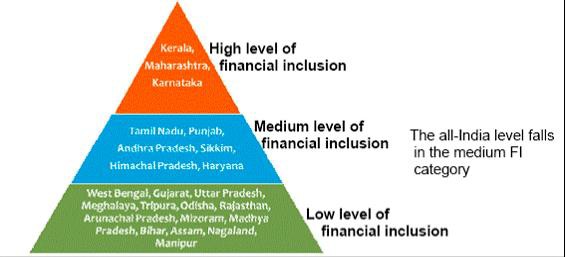

♤ The index readings for fiscal year 2015-16 show that FI has improved significantly, with the all-India score rising to 58 in FY 2015-16, compared with 50.1 in FY 2012-13. The PMJDY and RBI’s steadfast focus on unbanked regions have made a big difference.

♤ As many as 600 million deposit accounts were opened between FY 2012-13 and FY 2015- 16, which is twice the number between 2010 and 2013. Nearly a third of this was on account of PMJDY.

♤ There has also been a sharp incremental rise in number of people availing credit, to 31.7 million. This figure includes loans extended by banks and microfinance institutions together in the two years up to FY 2015-16, which is the highest since FY 2012-13.

♤ Notably, microfinance institutions contributed significantly to the financially under- penetrated regions. The Digital India initiative, payment banks, and small finance banks have all helped improve the outreach of formal financial services to economically disadvantaged sections of the populace and geographically remote regions.