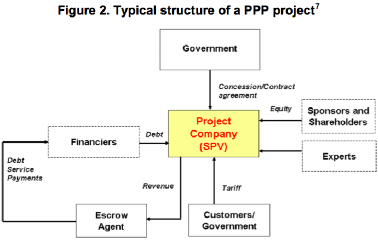

Understanding the basic structure of a PPP arrangement

A typical PPP structure can be quite complex involving contractual arrangements between a number of parties, including the government, project sponsor, project operator, financiers, suppliers, contractors, engineers, third parties (such as an escrow agents), and customers. The creation of a separate commercial venture called a Special Purpose/Project Vehicle (SPV) is a key feature of most PPPs. The SPV is a legal entity that undertakes a project and negotiates contract agreements with other parties including the government. An SPV is also the preferred mode of PPP project implementation in limited or non-recourse situations, where the lenders rely on the project’s cash flow and security over its assets as the only means to repay debts

♤ The actual structure of a PPP, however, depends on the type of partnership model and can be quite complex involving contractual arrangements between a number of parties including the government, project sponsor, project operator, financiers, suppliers, contractors, engineers, third parties (for example, an escrow agent), and customers.

♤ An SPV is usually set up by the private concessionaire/sponsor(s), who in exchange for shares representing ownership in the SPV contribute the long-term equity capital, and agree to lead the project. The SPV may not always be directly owned by the sponsors. They may use a holding company for this purpose.

♤ An important characteristic of an SPV as a company is that it cannot undertake any business that is not part of the project. An SPV as a separate legal entity protects the interests of both the lenders and the investors. The formation of an SPV has also many other advantages. A project may be too large and complicated to be undertaken by one single investor considering its investment size, management and operational skills required and risks involved. In such a case, the SPV mechanism allows joining hands with other investors who could invest, bring in technical and management capacity and share risks, as necessary.

♤ The government may also contribute to the long-term equity capital of the SPV in exchange of shares. In such a case, the SPV is established as a joint venture company between the public and private sectors and the government acquires equal rights and equivalent interests to the assets within the SPV as other private sector shareholders.

♤ Sometimes, governments want to ensure a continued interest (with or without controlling authority) in the management and operations of infrastructure assets such as a port or an airport particularly those which have strategic importance, or in assets that require significant financial contribution from the government. In such a case, a joint venture may be established. A joint venture is an operating company owned by a government entity and a private company (or multiple companies including foreign companies if permitted by law), or a consortium of private companies.

♤ Often, an SPV is formed as a joint venture between an experienced construction company and a service operations company capable of operating and maintaining the project.

♤ Other than its strategic, financial and economic interest, the government may also like to directly participate in a PPP project. The main reasons for such direct involvement may include:

o To hold interest in strategic assets;

o To address political sensitivity and fulfil social obligations;

o To ensure commercial viability of the project;

o To provide greater confidence to lenders; and

o To have better insight to protect public interest.

Direct government involvement in a PPP project is usually guided by the legal and regulatory regime of the country and the government policy on PPPs. For example, the government may hold certain defined percentage of the stake in a strategic project such as an airport or a port.