2.4.4. Models of PPP

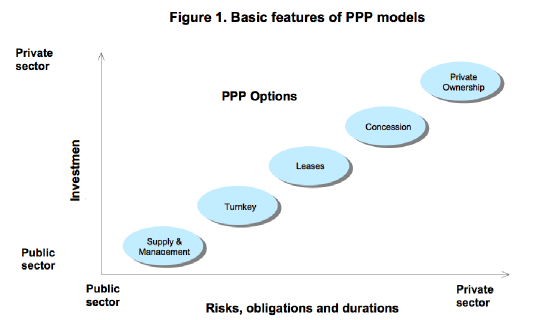

A wide spectrum of PPP models has emerged. These models vary mainly by:

♤ Ownership of capital assets;

♤ Responsibility for investment;

♤ Assumption of risks; and

♤ Duration of contract.

The PPP models can be classified into following broad categories in order of generally (but not always) increased involvement and assumption of risks by the private sector. These categories are:

♤ Supply and management contracts

♤ Turnkey contracts

♤ Affermage/Lease

♤ Concessions

♤ Private Finance Initiative (PFI) and Private ownership.

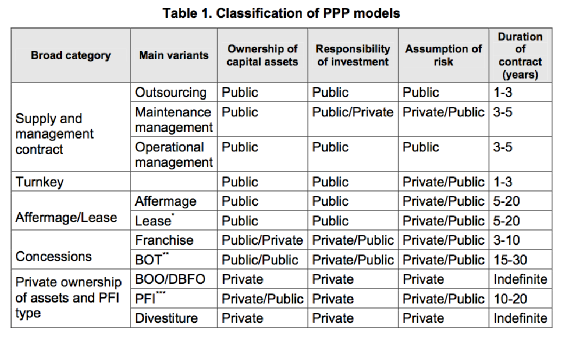

A categorization of the PPP models together with their main characteristics is shown in table 1. While the spectrum of models shown in the table are possible as individual options, combinations are also possible such as, a lease or (partial) privatization contract for existing facilities which incorporates provisions for expansion through Build-Operate- Transfer.

*Build-Lease-Transfer (BLT) is a variant.

**Build-Operate-Transfer (BOT) has many other variants such as Build-Transfer-Operate (BTO), Build-Own- Operate-Transfer (BOOT) and Build-Rehabilitate-Operate-Transfer (BROT).

***The Private Finance Initiative (PFI) model has many other names. In some cases, asset ownership may be transferred to, or retained by the public sector.

The main features of each of the broad categories of the PPP models are discussed next.

Supply and Management Contracts

A management contract is a contractual arrangement for the management of a part or whole of a public enterprise (for example, a specialized port terminal for container handling at a port or a utility) by the private sector. Management contracts allow private sector skills to be brought

into service design and delivery, operational control, labour management and equipment procurement. However, the public sector retains the ownership of facility and equipment. The private sector is assigned specified responsibilities concerning a service and is generally not asked to assume commercial risk.

The private contractor is paid a fee to manage and operate services. Normally, the payment of such fees is performance-based. Usually, the contract period is short, typically three to five years. But the period may be longer for large and complex operational facilities such as a port or an airport.