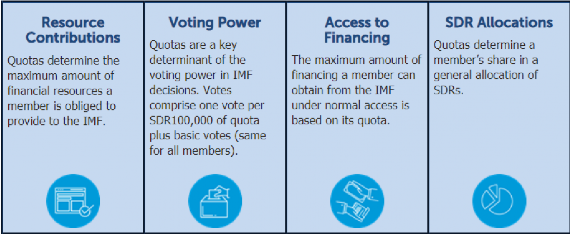

2.1.3.1. Multiple role of Quotas

The IMF regularly conducts general reviews of quotas to assess the adequacy of overall quotas and their distribution among members. The 14th Review was concluded in 2010 and the quota increases in that review became effective in 2016. (see box)

Impact of 2016 IMF reforms

♤ The reforms doubled quota resources to SDR 477 billion (about US$660 billion).

♤ The emerging and developing economies gained more influence in the governance architecture of the International Monetary Fund (IMF).

♤ More than six per cent of the quota shares will shift to emerging and developing countries from the

U.S. and European countries.

♤ India’s voting rights increase to 2.6 per cent from the current 2.3 per cent, and China’s, to 6 per cent

from 3.8, as per the new division.

♤ The reforms bring India and Brazil into the list of the top 10 members of IMF, along with the U.S, Japan, France, Germany, Italy, the United Kingdom, China and Russia.

♤ For the first time, four emerging market countries of the BRIC bloc —Brazil, China, India, and Russia

—will be among the 10 largest members of IMF. Canada and Saudi Arabia slip below the top ten in the process.

♤ As part of the reforms, for the first time, the IMF’s Executive Board will consist entirely of elected Executive Directors, ending the category of appointed Executive Directors. Currently the members with the five largest quotas appoint an Executive Director, a position that will cease to exist.

The IMF's Board of Governors conducts general quota reviews at regular intervals (no more than five years). Any changes in quotas must be approved by an 85 percent majority of the total voting power, and a member’s own quota cannot be changed without its consent. The U.S.’s vote share is 16.52% giving it a unique veto power over crucial decisions at the IMF, many of which require a supermajority of 85%.